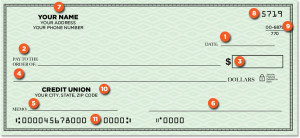

You May Be Committing Check Fraud and Don’t Know It: What You Need to Know

Did you get a check in the mail from an organization or person you don’t know saying that you’ve won a lottery or contest or asking you to deposit it as a favor to them?

If you have, do not deposit into your account. It is a scam. “The lottery angle is a trick to get you to wire money to someone you don’t know,” said the Federal Trade Commission . “If you were to deposit the check and wire the money, your bank would soon learn that the check was a fake. And you’re out the money because the money you wired can’t be retrieved, and you’re responsible for the checks you deposit — even though you don’t know they’re fake.”

. “If you were to deposit the check and wire the money, your bank would soon learn that the check was a fake. And you’re out the money because the money you wired can’t be retrieved, and you’re responsible for the checks you deposit — even though you don’t know they’re fake.”

To avoid the counterfeit check scam, the Federal Trade Commission recommends you do the following:

- Throw away any offer that asks you to pay for a prize or a gift. If it’s free or a gift, you shouldn’t have to pay for it. Free is free.

- Resist the urge to enter foreign lotteries. It’s illegal to play a foreign lottery through the mail or the telephone, and most foreign lottery solicitations are phony.

- Know who you’re dealing with, and never wire money to strangers.

- If you’re selling something, don’t accept a check for more than the selling price, no matter how tempting the offer or how convincing the story. Ask the buyer to write the check for the correct amount. If the buyer refuses to send the correct amount, return the check. Don’t send the merchandise.

- As a seller, you can suggest an alternative way for the buyer to pay, like an escrow service or online payment service. There may be a charge for an escrow service. If the buyer insists on using a particular escrow or online payment service you’ve never heard of, check it out. Visit its website, and read its terms of agreement and privacy policy. Call the customer service line. If there isn’t one — or if you call and can’t get answers about the service’s reliability — don’t use the service.

- If you accept payment by check, ask for a check drawn on a local bank, or a bank with a local branch. That way, you can make a personal visit to make sure the check is valid. If that’s not possible, call the bank where the check was purchased, and ask if it is valid. Get the bank’s phone number from directory assistance or an Internet site that you know and trust, not from the check or from the person who gave you the check.

- If the buyer insists that you wire back funds, end the transaction immediately. Legitimate buyers don’t pressure you to send money by wire transfer services. In addition, you have little recourse if there’s a problem with a wire transaction.

- Resist any pressure to “act now.” If the buyer’s offer is good now, it should be good after the check clears.

- If you think you’ve been targeted by a counterfeit check scam, report it to he Federal Trade Commission, the U.S. Postal Inspection Service, and your state or local consumer protection agencies. Visit www.naag.org for a list of state Attorneys General, or check the Blue Pages of your local telephone directory for appropriate phone numbers.